for Ecommerce

The proof is in the data: Use these insights to create better SMS marketing campaigns in 2023.

Want a PDF version of our overall benchmarks or any of the individual industry reports? Enter your email below, select the report you'd like, and we'll deliver it straight to your inbox.

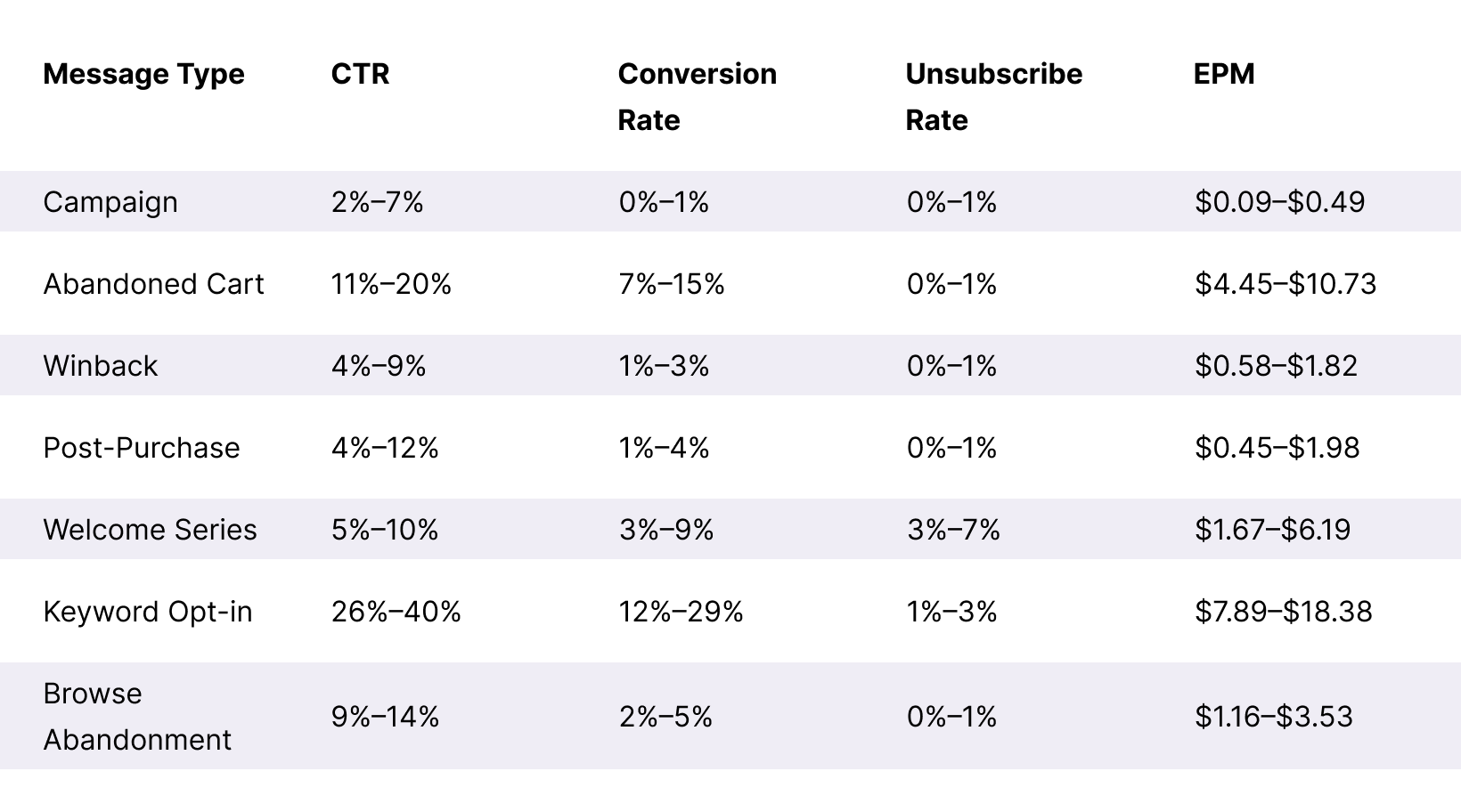

Overall Benchmarks

If your shop doesn’t fit into one of the specific industry categories featured in this report, these numbers are a great starting point for assessing your SMS performance.

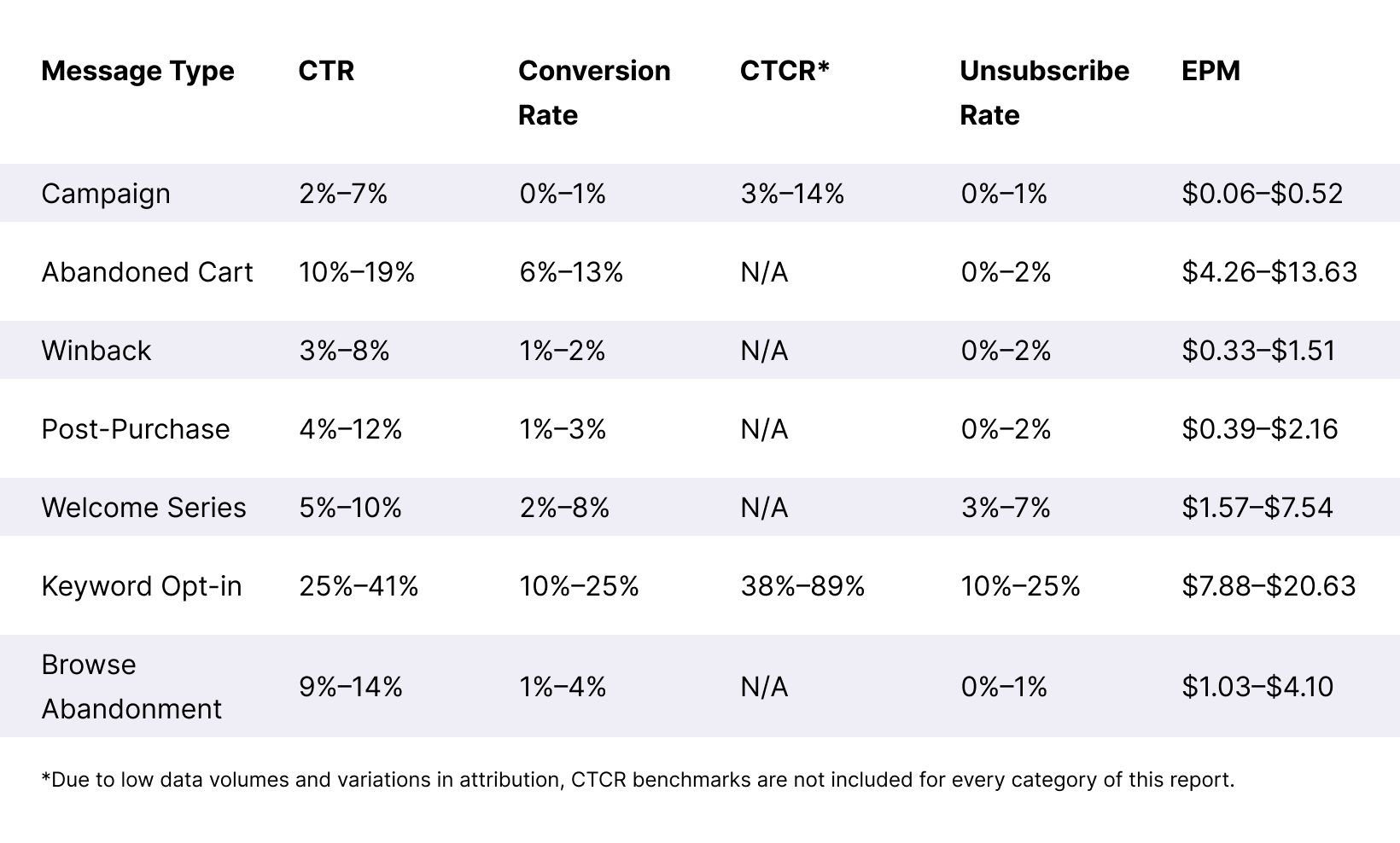

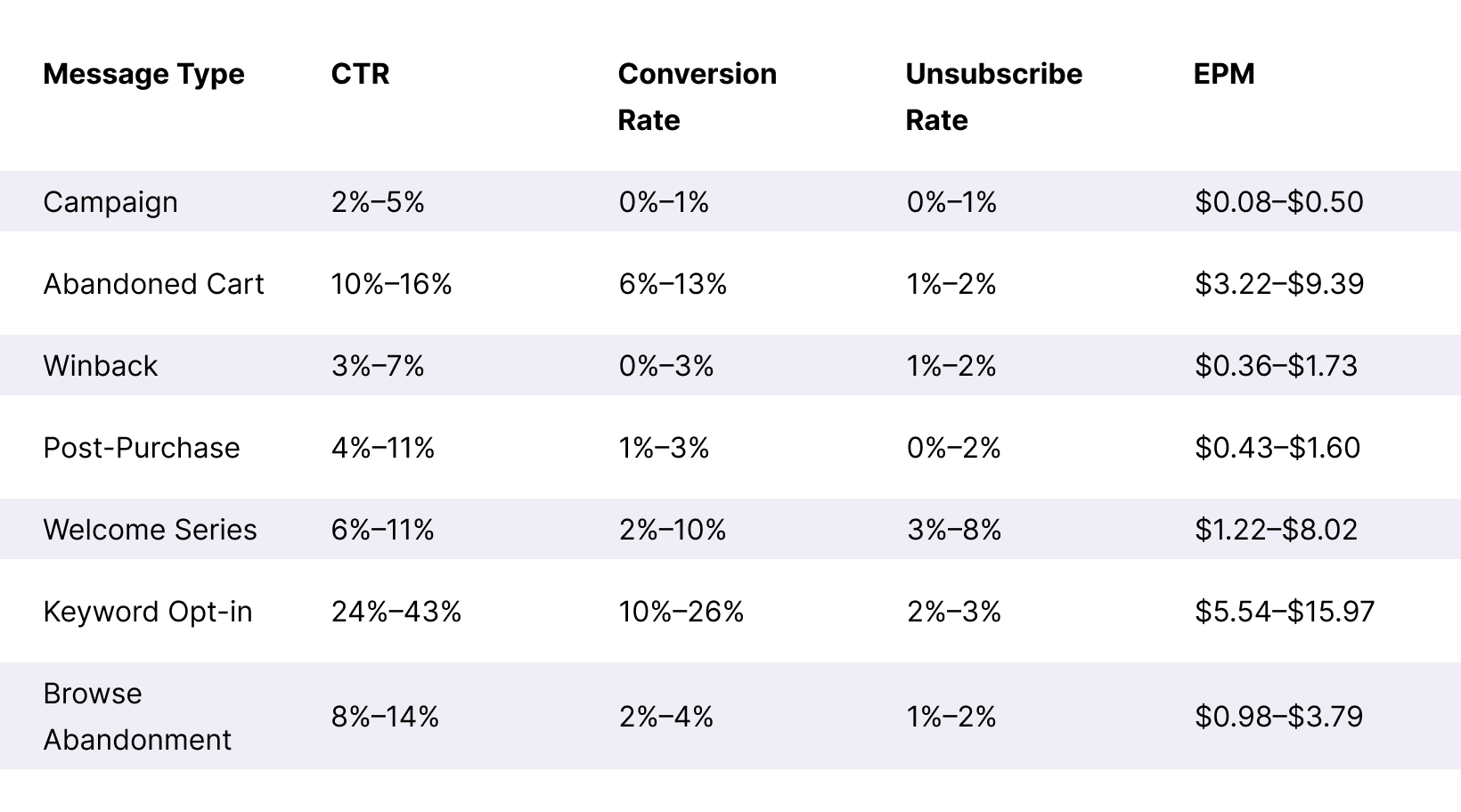

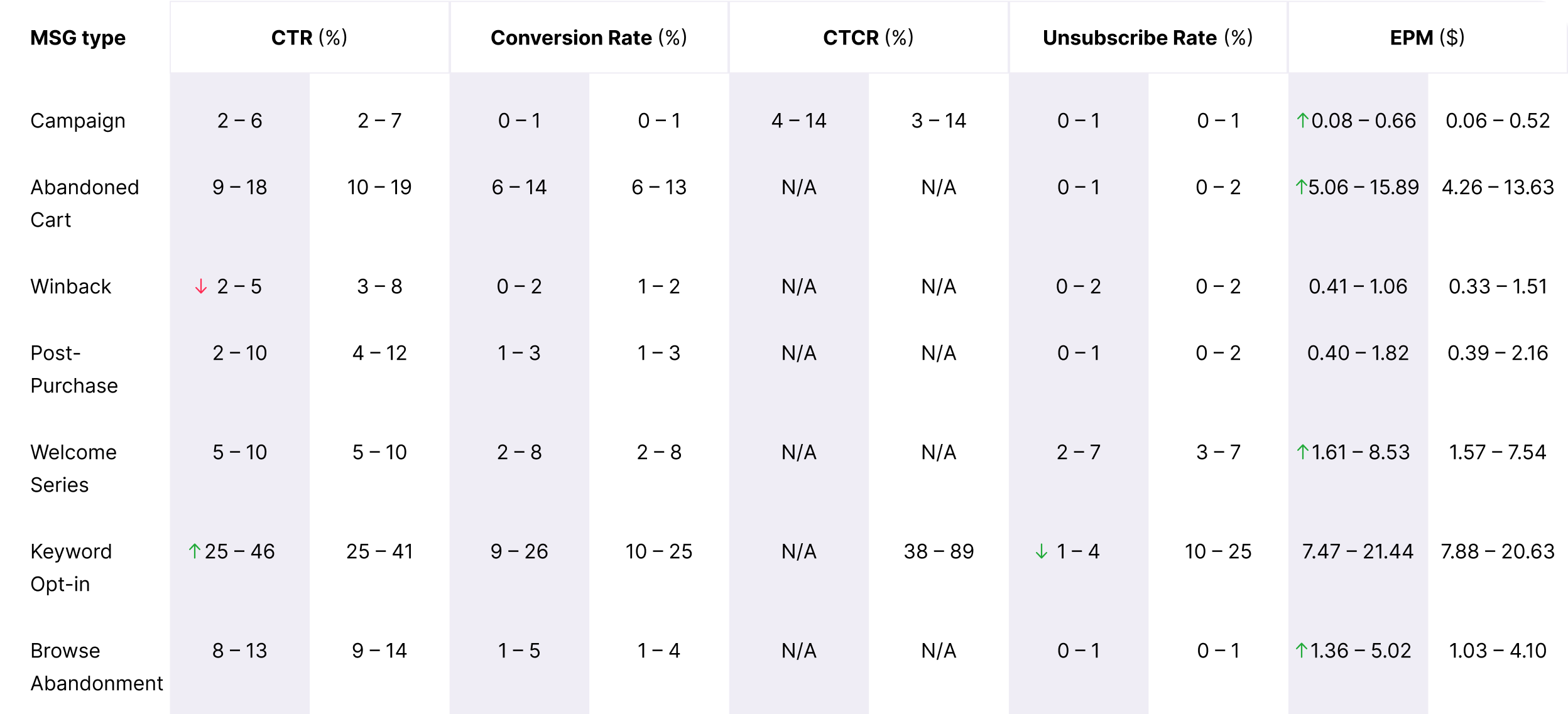

Overall Message Benchmarks

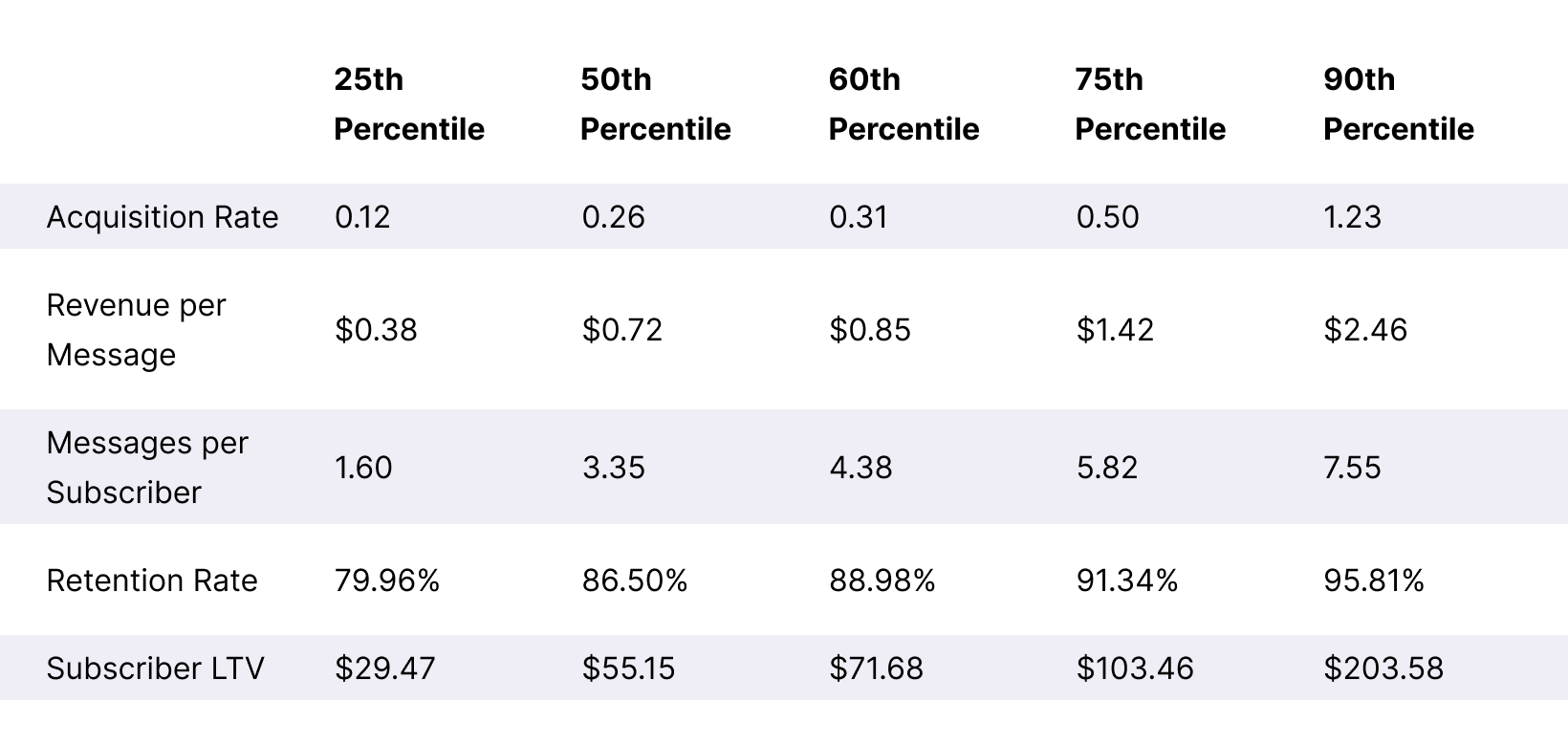

Overall ARMR + Subscriber LTV Benchmarks

Key Takeaways

Compared to 2022, brands saw higher overall performance from Welcome Series and Keyword Opt-in messages. This suggests they are doing a better job collecting high-intent subscribers and providing good initial experiences via SMS.

On the flipside, brands lost ground with Campaigns, Abandoned Carts, Winbacks, and Post-Purchase messages. As more brands adopt SMS, it is becoming more crucial to tailor message content to specific subscribers and to level up the quality of message creative to capture and maintain subscriber interest.

Benchmarks by Industry

Each individual industry has a different customer profile, different best practices for reaching those customers, and different expectations for their various marketing efforts. In essence, there is no one-size-fits-all approach. After all, a ski shop and a baby food store probably shouldn’t text their customers the same way. We looked at the top 5 ecommerce industries and analyzed their success with SMS marketing.

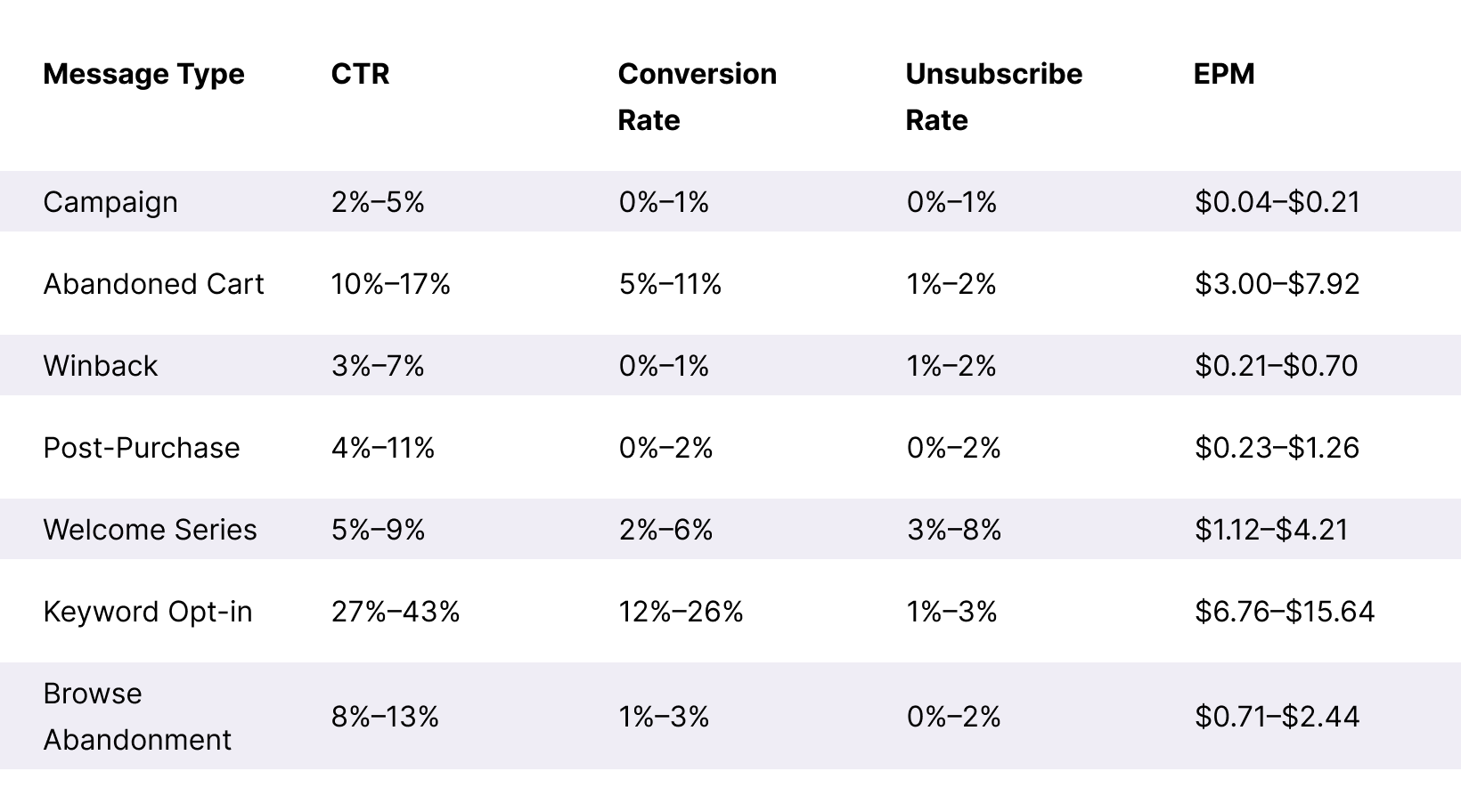

Apparel

From streetwear to swim trunks and evening gowns to athleisure,

apparel brands can gather insights from these SMS benchmarks.

Apparel Message Benchmarks

Apparel ARMR + Subscriber LTV Benchmarks

Key Takeaways

Apparel brands saw exceptionally strong performance with Campaigns and Post-Purchase automations. Build on that momentum by creating multiple versions of these messages to target specific segments of subscribers—based on products purchased or amount spent, for example.

Home Goods

It takes a lot to furnish a home! From candles to bedding—and beyond!—all the items that go into decorating or enhancing your home belong here.

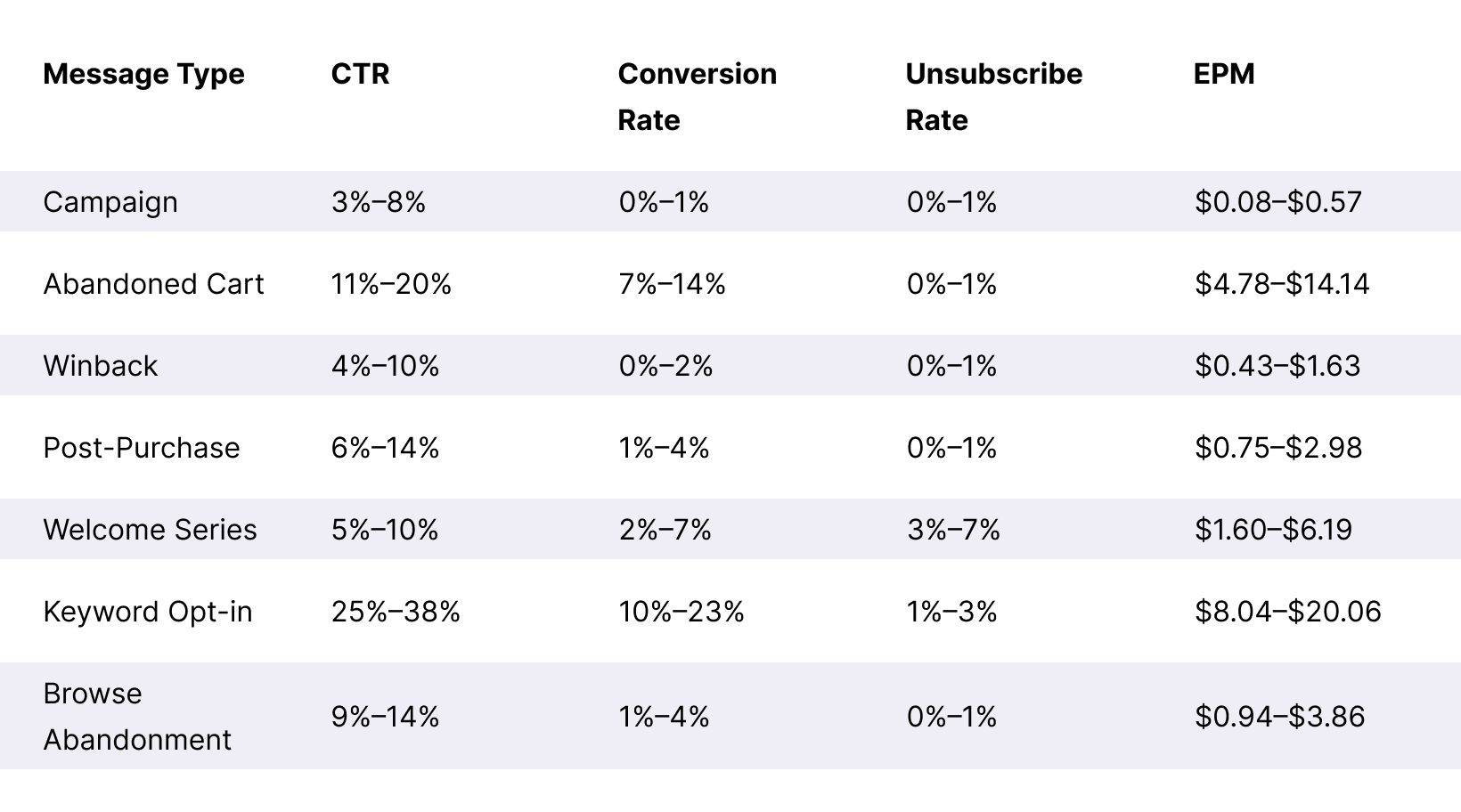

Home Goods Message Benchmarks

Home Goods ARMR + Subscriber LTV Benchmarks

Key Takeaways

For brands in the Home Goods category, Campaigns delivered the best results compared to overall performance across all brands. However, performance lagged in Messages per Subscriber and Retention Rate.

Make sure you’re fully capitalizing on Campaign opportunities throughout the year, but also strive to maintain subscriber engagement between sale or launch events. Try using conversational messaging to gather zero-party data and create targeted segments for future campaign sends.

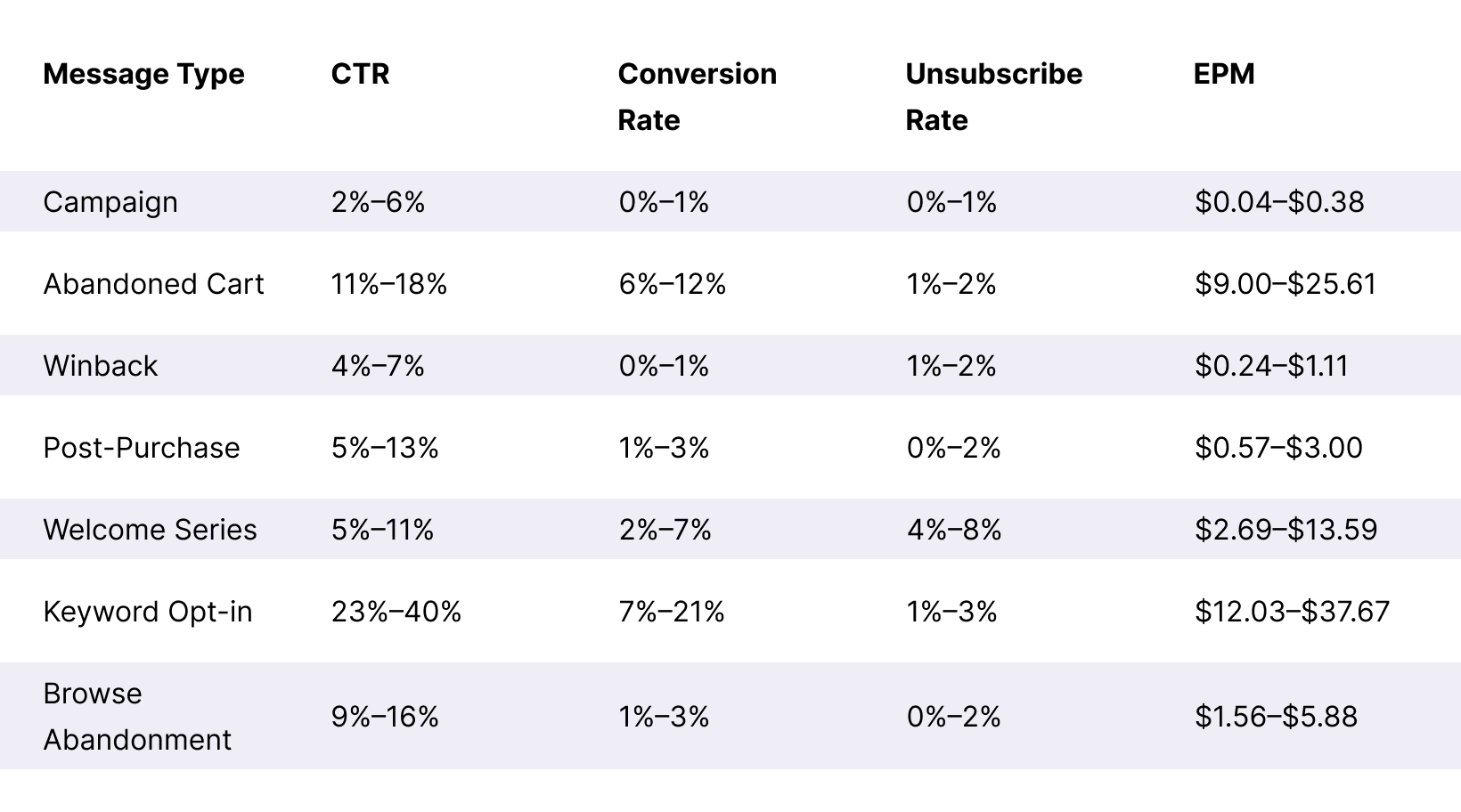

Beauty/Cosmetics

Whether you’re in the business of selling lip-kits, hair-styling tools, or skincare products,

this is the data for you.

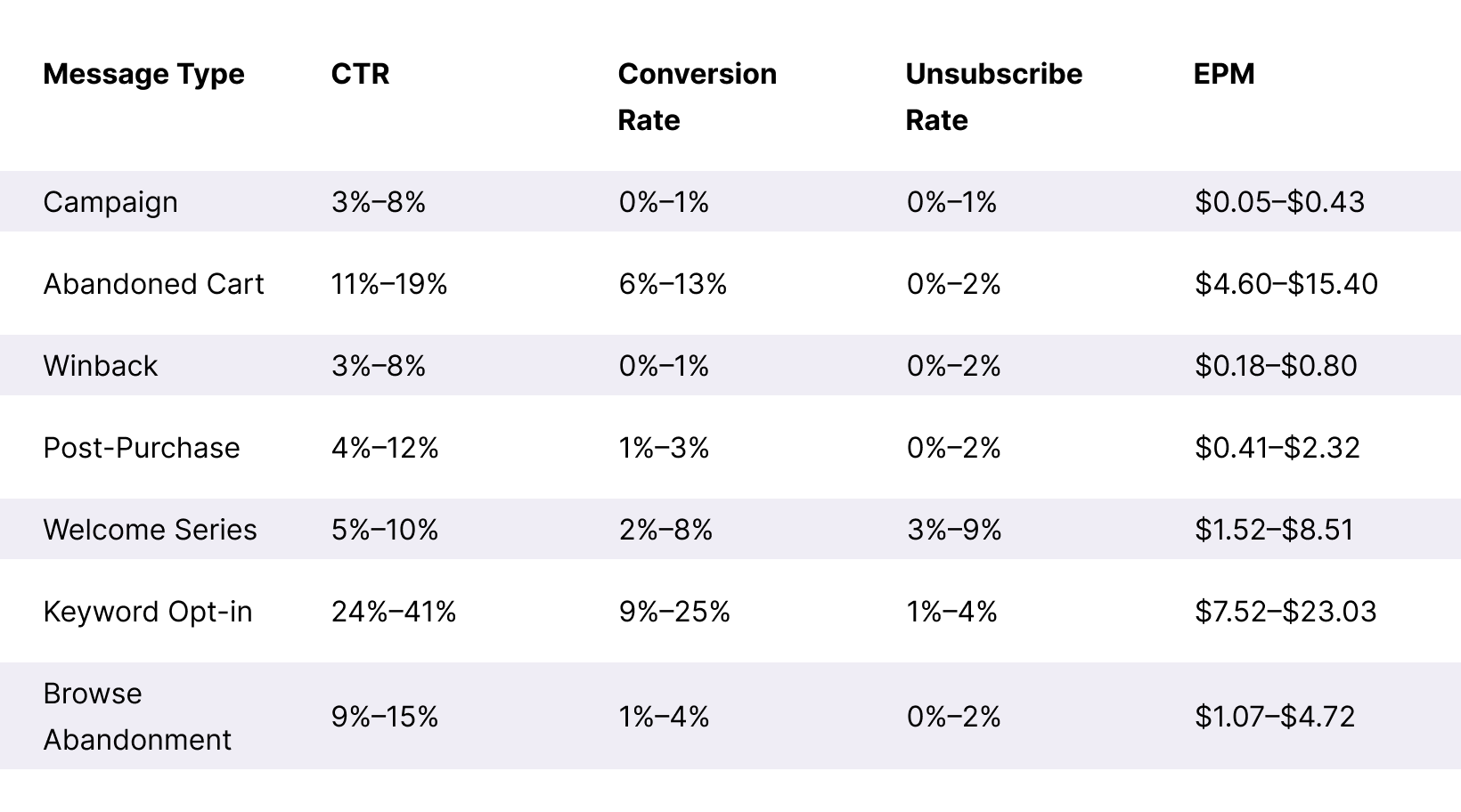

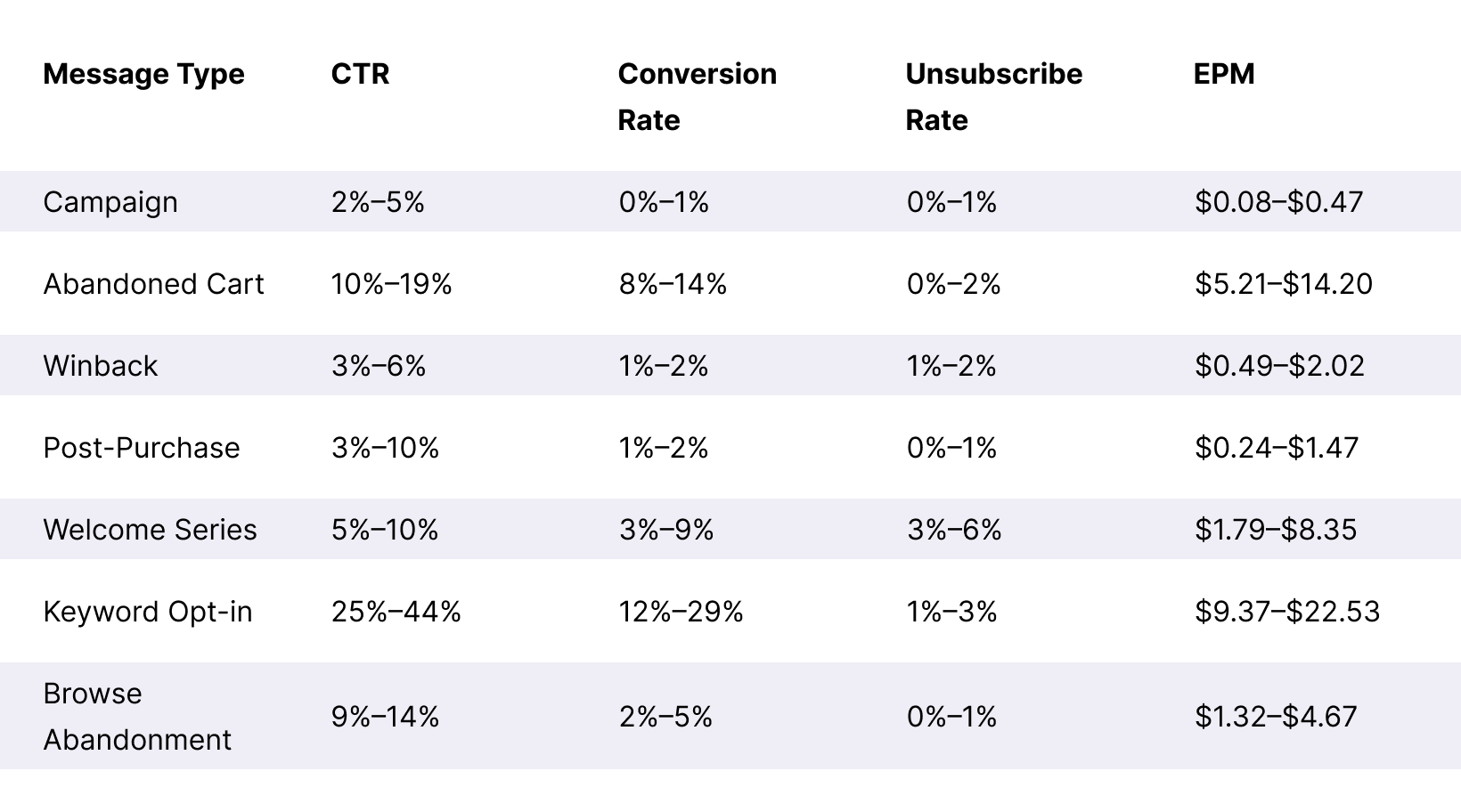

Beauty/Cosmetics Message Benchmarks

Beauty/Cosmetics ARMR + Subscriber LTV Benchmarks

Key Takeaways

Beauty brands outperform overall ecommerce averages for Keyword Opt-in messages, which suggests they are doing a great job capturing high-intent subscribers. To keep them engaged and generate additional purchases, try leveraging conversational or educational messages to answer questions, learn more about each customer’s needs and interests, and increase product adoption.

Food/Beverage

This section is for all purveyors of coffee, snacks, and meal prep products—people need to eat and drink!

Food/Beverage Message Benchmarks

Food/Beverage ARMR + Subscriber LTV Benchmarks

Key Takeaways

Compared to overall averages, Food/Beverage brands logged exceptional Welcome Series performance. To keep the subscriber engagement going after those initial messages, try including a contact card message as part of the Welcome Series or setting subscribers up for a more personalized future experience by asking them to respond with the type of products or content they are specifically interested in.

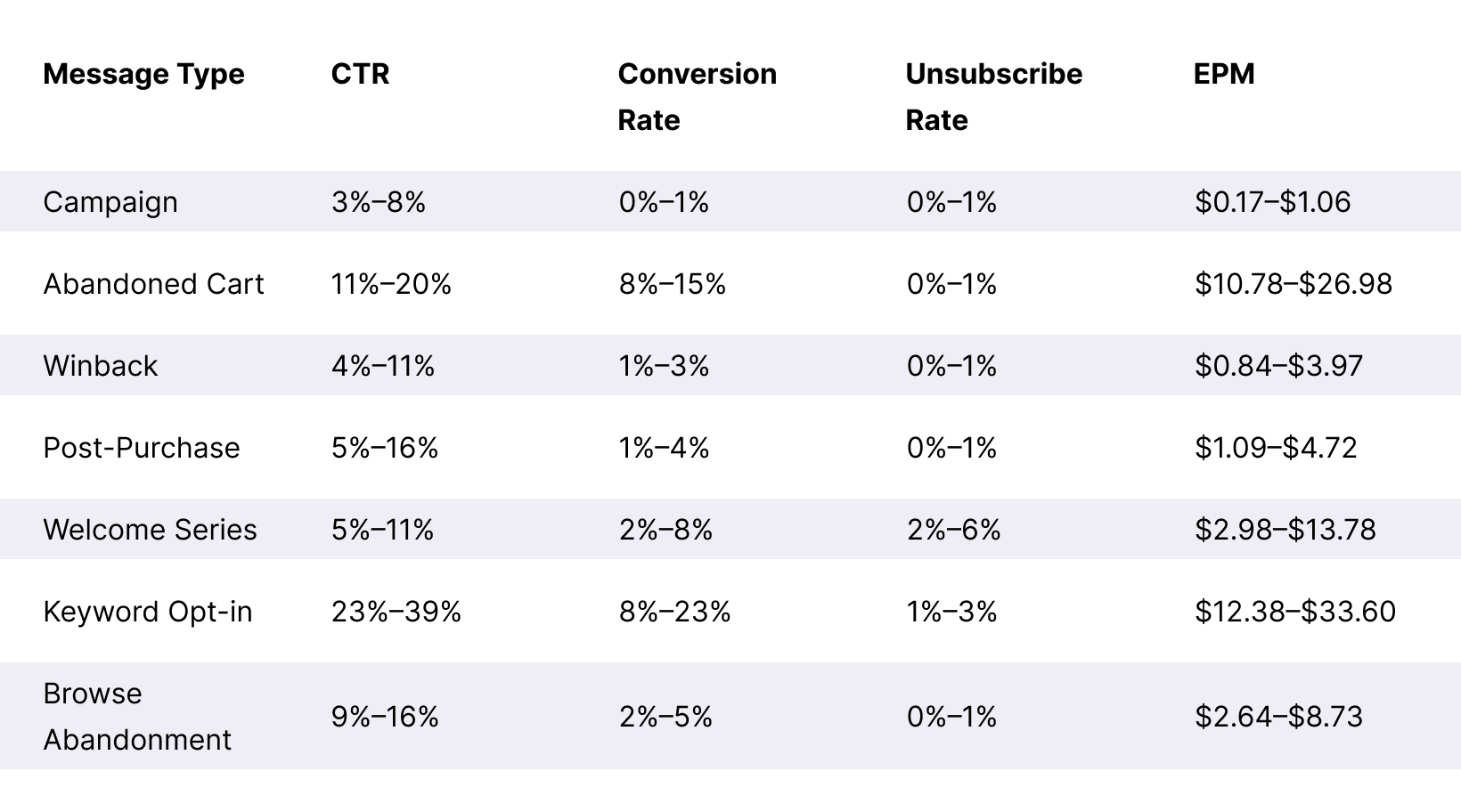

Health/Wellness

Does your shop cater to consumers’ mental and physical well-being? If so, then this is the section for you.

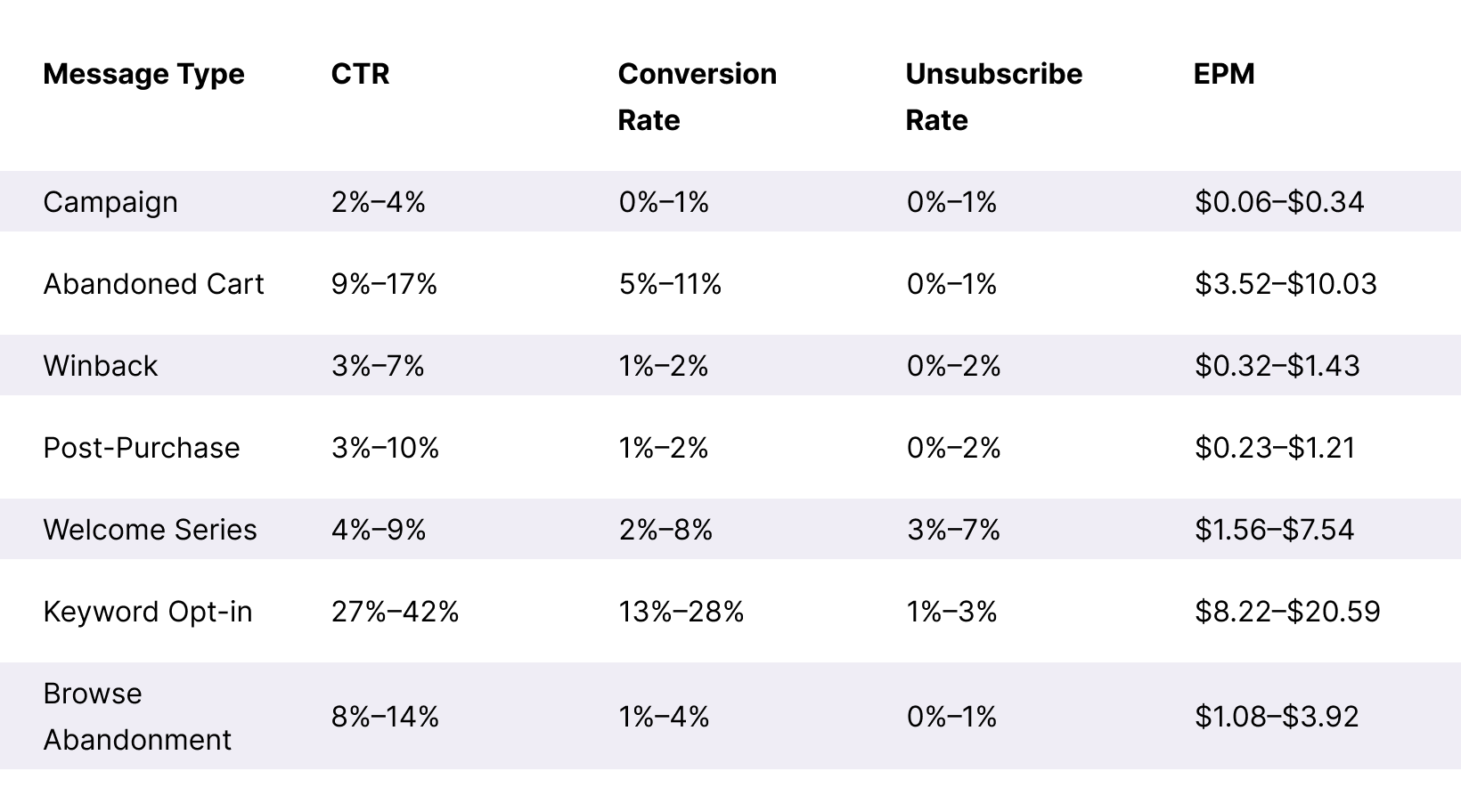

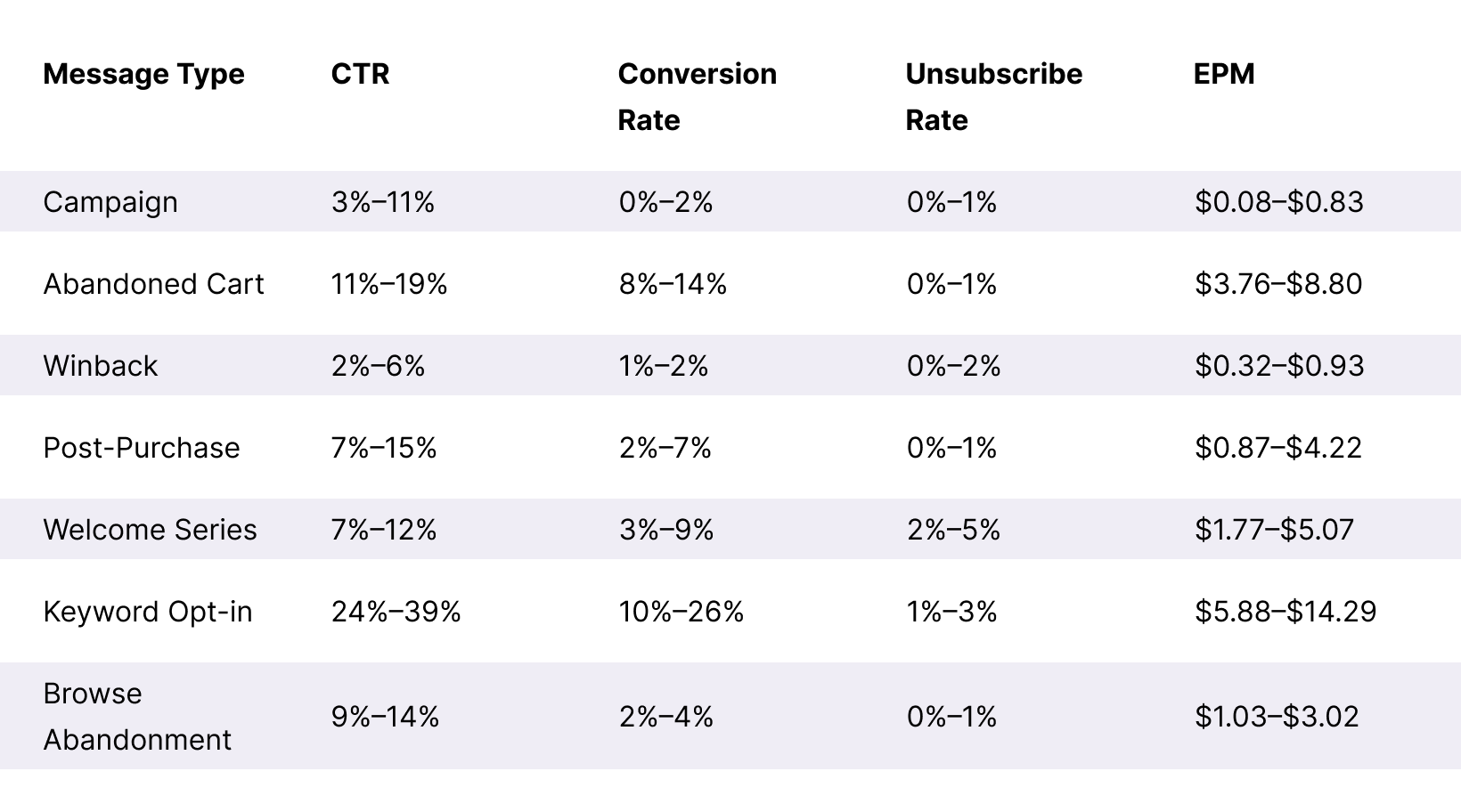

Health/Wellness Message Benchmarks

Health/Wellness ARMR + Subscriber LTV Benchmarks

Key Takeaways

Health/Wellness brands saw higher-than-average conversion rates for Abandoned Cart and Browse Abandonment automations. To make those messages even more effective, try including a photo of and/or link to a specific product variant the subscriber showed interest in.

These brands also had a much lower-than-average Acquisition Rate, suggesting that they should put more focus and effort into their list growth efforts. Make sure you’re giving shoppers the opportunity to subscribe on your website, at checkout, through your email messages, and via social media.

Benchmarks by Product Persona

SMS marketing performance varies depending on the types of products a shop sells as well as how frequently customers typically purchase those products. We separated products into five “personas” based on factors like cost, number of purchases, and time between orders.

Small Subscription Spends

Monthly, recurring purchases of inexpensive goods and consumables

AOV under $100

Repurchased more than 25% of the time

Purchased fewer than 45 days apart

Examples: Subscription-based snack and coffee products or regularly-purchased skincare products

Key Takeaways

Compared to overall averages, Post-Purchase messages perform exceptionally well for Small Subscription Spend products. If your brand focuses on this product type, make sure you set up—and continuously test—this automation to get the most out of it. For example, you may want to test the timing (e.g., three weeks versus six weeks post-purchase) or try adding a photo or GIF to any upsell or cross-sell messages.

Occasional Orders

Occasional purchases of inexpensive goods and consumables

AOV under $100

Repurchased more than 25% of the time

Purchased more than 45 days apart

Examples: Beauty/cosmetics products and most clothing products

Key Takeaways

Winbacks are an important automation for Occasional Orders, and customers often need to be reminded of your brand and product in order to realize that they need or want to purchase from you again. And compared to overall averages, Winbacks perform especially well for this product type. To optimize Winback performance, try testing different offers (e.g., free gift versus discount) and time windows (e.g., no purchase after 30 days versus no purchase after 60 days). You could also try segmenting based on number of past purchases or total amount spent. For example, a customer who has purchased more than five times may only need a new product announcement to come back and buy again—whereas someone who has only purchased once may need some type of offer in order to convert.

Single-Stop Gifts

Single-purchase inexpensive goods

AOV under $100

Repurchased less than 25% of the time

Examples: Baby items or wedding gifts as well as products that are part of small catalogs of niche items

Key Takeaways

Keyword Opt-in messages yield the best results for Single-Stop Gifts in comparison to overall averages, which makes sense considering that many shoppers land on your site for the first time in search of a gift for someone else. So, test your offers and acquisition sources (social media, website popup, etc.), but don’t forget to engage buyers after they’ve converted. Post-Purchase and Winback messages show strong performance for this product type, so be sure to follow up with upsell and cross-sell offers or sale announcements during heavy gifting periods (e.g., Valentine’s Day and Mother’s Day).

One-Time Luxuries

Single-purchase luxury goods

AOV more than $100

Repurchased less than 25% of the time

Examples: Big-ticket athletic purchases such as skis and other large purchases like furniture, jewelry, and art

Key Takeaways

Keyword Opt-in and Welcome Series messages perform well in this category and are logical places to focus for brands catering mostly to one-time buyers. That being said, there is clear value in continuing to engage those buyers after they’ve purchased. In fact, Post-Purchase message performance for this product category is stronger than overall averages—suggesting that past buyers do purchase again eventually (or continue to purchase supplementary products and accessories). Fostering loyalty and keeping your brand top-of-mind for high-end product purchasers can also lead to word-of-mouth referrals and boost your review and UGC collection efforts. So, don’t sleep on the opportunity to stay in touch with subscribers!

Recurring Splurges

Luxury goods purchased periodically

AOV more than $100

Repurchased more than 25% of the time

Examples: Upscale clothing and footwear, big-ticket beauty items like hair extensions, certain home goods and athletic gear

Key Takeaways

Recurring Splurges show strong message performance across the board, indicating that SMS is a very lucrative channel for this product category. Post-Purchase and Winback messages appear to yield particularly excellent results, so it’s important for brands in this product category to focus equally on converting prospects into buyers and converting buyers into repeat customers. That means testing things like loyalty offers and Post-Purchase message timing as well as strategically segmenting based on past purchase behavior (e.g., type and number of products purchased or total dollar amount spent).

BFCM Benchmarks

Here are overall benchmarks for messages sent during the 2022 Black Friday/Cyber Monday period, which we’ve defined as November 22, 2022, through November 29, 2022. Shops included in this analysis met all of the criteria for overall inclusion and were installed for at least 3 months prior to Black Friday (November 25, 2022).

Love this report?

Subscribe to have more content like this delivered straight to your inbox.

We are big fans of privacy. See our Privacy Policy for more information.

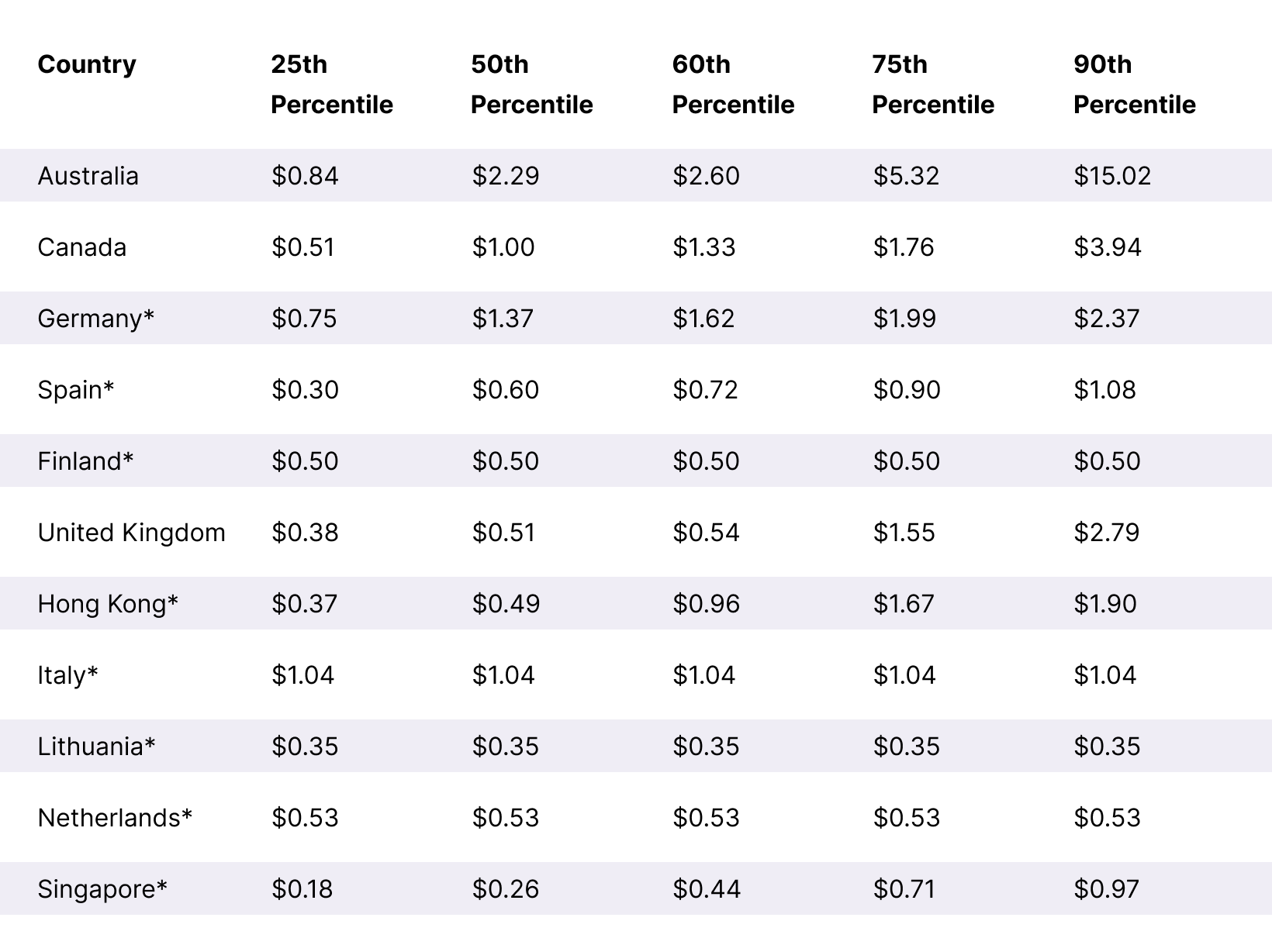

International Benchmarks

Here are the Earnings per Message benchmarks by percentile in United States Dollars (USD) as well as the native currency for each eligible country. Please note that countries of origin were assigned based on country codes. Asterisks (*) indicate low data volume, resulting in skewed analysis.

International EPM Benchmarks in USD

International EPM Benchmarks in Native Currency

Conversion rate calculated on 2/6/2023

Strategies for Improving Your Scores

Not quite performing at the level you’d like? Here are some levers you can pull to improve your score for each metric and message type.

How to Improve Message Performance

Create a sense of urgency by communicating hard limits on the offer (e.g., “Available to the first 50 shoppers,” or “Deal ends at midnight”).

Inject FOMO by emphasizing the rarity of the offer or the scarcity of the product (e.g., “Don’t miss out on our biggest sale of the year,” or “Get our most-loved formula before supplies run out”).

Stoke subscribers' curiosity about something they haven’t seen (e.g., “Shop all 5 new colors now,” or “Check out our brand-new drop”).

Personalize your messaging and/or offer based on past engagement or purchase behavior (e.g., “See the perfect red striped hat to match your red striped scarf,” or “Get the flavor that’ll pair perfectly with your Chocolate Cherry”).

Test non-sales focused CTAs (e.g., “Jam out to our hot new summer playlist now,” or “Take your smoothie game to the next level with this delicious recipe”).

Use specific product links based on subscriber data and/or purchase history (size, color, flavor, etc.).

Use discount links so the deal is automatically applied.

Send follow-up messages to those who don’t convert on the first message (especially during busy times like BFCM or holidays).

Test teasing a “mystery offer” applied at checkout.

Set expectations around message content and frequency in your Welcome Series.

Send new subscribers your contact card and encourage them to save you as a contact.

Use response branching to ask subscribers about their message preferences, and create tags for future segmentation.

Vary your message content so not every send is sales-focused.

Consistently deliver SMS-only perks like special deals and early access.

Provide post-purchase value with product education and SMS-only rewards.

Use clear, specific, enticing CTAs (e.g., “Get Health Magazine’s #1 recommended collagen supplement for 25% off,” instead of “Shop now”).

Double-down on promotions for higher-ticket items.

Try promoting a “buy more, save more” deal.

Tweak messaging and offers for different subscriber segments versus sending one blanket campaign to your full list.

Reserve full-list sends for major announcements and sale events.

Plan a Campaign calendar at the beginning of each month or quarter to hold yourself accountable to sending consistent, compelling Campaign messages.

Mix up your offers and A/B test different strategies to see what resonates most with your subscribers. For example, test a free gift offer against a discount offer.

Segment subscribers based on past behavior or known attributes, and use that information to create more targeted messaging.

Mix up your creative and focus on creating engaging, original copy. Try using images and GIFs, especially for product-focused messages.

Try a response-based Campaign to foster two-way engagement. Use Campaign Flow Builder to create unique replies for each incoming response. Bonus: Use responses to segment subscribers based on preferences (e.g., “Reply with SALTY or SWEET to let us know what you’re craving”). That way, you can make future sends/follow-ups more personalized.

Experiment with different promotional strategies like discounts, free shipping, free gifts, or reviews and other forms of social proof. You can only send one SMS message per abandoned cart event—so it’s important to figure out which strategy is most effective in getting subscribers to complete their orders.

Have different Abandoned Cart messages for different products or categories of products.

Use specific product links (i.e., at the variant level) and include a product image with your message.

Fine-tune your Winback strategy. Run A/B tests with various offers and test different time windows to see what performs best.

Target lapsed buyers multiple times at several intervals—30, 60, or even 90 days later—with a limited-time discount code to encourage them to come back and buy again.

Segment based on products purchased and/or total orders or amount spent. Tailor your messaging accordingly to make it feel more personalized (e.g., “Loving your Red Rose lipstick? Then you’ll really love our new Magnificent Mulberry. Get yours for 15% off now.”).

Try a conversational Winback flow for past purchasers who have gone dark. Ask them to reply with what they’re looking for, whether it’s tips, deals, or just something fun.

Remember that there are several types of Post-Purchase messages to send, so your efforts here shouldn’t be one-and-done. These include loyalty, cross-sell, upsell, review request, UGC request, and product feedback request messages.

For consumable products, set up an automation that reminds subscribers to buy again (two weeks later, 30 days later, etc) to help drive repeat purchases.

Once an order is delivered, follow up with a Post-Purchase automation asking customers to share their purchase on social with your hashtags.

Use Post-Purchase automations to ask customers if they have any questions about their new product or to provide educational content (blog posts, videos, etc.) teaching them how to get the most out of it.

If you offer subscription savings, use a Post-Purchase automation to remind customers to sign up for subscriptions and nudge them toward becoming repeat customers.

Promote a loyalty offer or rewards program to incentivize folks to keep purchasing.

Try incorporating images or GIFs for product or brand-focused messages.

Create an engaging, multi-message Welcome Series to introduce new subscribers to your brand. Write a heartfelt message from the founder to explain your brand story and mission—or invite subscribers to share a little about themselves by texting back the keyword that best represents their interests or challenges.

Provide new subscribers a special offer right off the bat to capitalize on the high conversion potential of this automation.

Have different Welcome Series for different opt-in sources.

Share your contact card so you can become a known contact in subscribers’ phones.

Set expectations around the type and frequency of text messages subscribers can expect to receive from you.

Revisit active Welcome Series flows on a regular (e.g., quarterly) basis to freshen up or A/B test offers and message content.

Create and advertise multiple opt-in Keywords based on channel, audience, and context. The more targeted your messaging following opt-in, the better it will convert.

Consider putting more advertising dollars toward Keyword promotions. While these ads won’t lead to direct purchases, they may generate much higher long-term value in the form of a loyal SMS subscriber and customer.

Leverage high-performing acquisition channels like social media and paid advertising to promote opting in via Keyword. For example, you could run an ad with a CTA like, “Text DEALS to 54321 to sign up for weekly discounts delivered via text.” (Just be sure to incorporate the appropriate compliance language when collecting opt-ins.)

Use new product drops as an opportunity to collect Keyword Opt-ins by incentivizing first access to new arrivals. For example, “Text FRESH to 54321 to receive early access to our newest products.” This allows you to collect very high-intent subscribers.

Follow up with a limited-time offer that incentivizes shoppers who look but don’t buy to come back and purchase.

Test out including specific product images.

Make sure your link directs subscribers to the right product variant (the more specific, the better).

Test out your timing for this message.

Try different offers to see what resonates best with your subscribers (e.g., a standard 15% off discount or a “mystery” offer revealed at checkout).

How to Improve ARMR + Subscriber LTV

Level up your website popup design and make sure you’re leading with phone collection on both desktop and mobile.

Test different opt-in incentives.

Enable checkout collection.

Turn on collection for back-in-stock notifications.

Add banners or slide-ins promoting your SMS program to your website.

Link to your SMS opt-in landing page on your site nav or footer.

Send periodic email campaigns aimed at getting current email-only subscribers to opt into your SMS messaging.

Add an opt-in QR code to product packaging or tags.

Promote your SMS program to your social media followers.

Add more subscriber-triggered automations and optimize the ones you have in place.

Think about how you can further segment every automation and campaign to deliver more relevant, personalized messages and CTAs to subscribers.

Elevate your copywriting or test MMS versions of certain messages (especially those showcasing certain products). And don’t forget the emojis!

Test out different offers and CTAs for different segments (free shipping and returns, a bonus gift, buy more/save more, etc.).

Have as many automations running as possible (assuming they make sense for your subscribers and your customer journey).

Plan out timely campaign sends and flows in advance so you can hold yourself accountable. (Get our full-year SMS campaign calendar to make this super easy.)

Sprinkle in education and engagement-focused campaigns to break up sales-focused messaging.

Segment your audience and tailor your campaign messaging accordingly.

Look at when the majority of unsubscribes are happening to see if you can identify any patterns with regard to message type, content, or frequency.

Capitalize on opportunities for segmentation and customization to ensure subscribers receive messages that align with their interests, behavior, and place in the customer journey.

Lean into automations, which are triggered by subscriber action and thus, inherently more contextual than campaigns.

Ultimately, a low Subscriber LTV indicates one or more of the following:

Subscribers are churning out of your list too early to produce much attributed revenue.

You’re not providing relevant information and offers (which is dragging down your conversion rates and pushing people to unsubscribe).

You’re not sending enough messages to realize the full value of the channel (which may be the case if your retention rate is high, but you’re still not seeing the LTV you want).

Review your ARMR scores to see if there’s one particular category that’s dragging down your Subscriber LTV—and focus your efforts there.

Glossary

Clickthrough Rate—the percentage of message recipients who click on the included link.

The percentage of message recipients who purchase.

Click-to-Conversion Rate—the percentage of message clicks that lead to purchase.

The percentage of subscribers who unsubscribe from your messages.

Earnings per Message (EPM)—the average dollar amount each message generates.

The rate at which you are collecting new subscribers. Calculated by dividing the total number of new subscribers over the last 30 days by the total number of orders over the last 30 days.

The average dollar amount attributed to one message (across all messages sent). Calculated by dividing the total SMS-attributed revenue over the last 30 days by the total number of messages sent over the last 30 days.

The average number of text messages each subscriber receives in a month. Calculated by dividing the total number of messages sent over the last 30 days by the total number of subscribers.

The percentage of new subscribers who stay subscribed past the one-month mark. Calculated by dividing the number of subscribers who remained on your list for their entire first 30 days by the total number of subscribers on your SMS list that opted in during that period.

The average dollar amount each subscriber spends over the life of their subscription.

* Research Methodology

Data was taken from all Postscript stores with active accounts between January 1, 2022, and December 31, 2022. The aggregate statistics reported here were taken from campaigns and automation flows sent to 200 subscribers or more. In the case of automation flows, the earnings per message (EPM), conversion rates, and unsubscribe rates are defined here as revenue earned, purchase counts, and unsubscribes (respectively) per subscriber who entered the automation flow. The click-through rates are defined as the number of unique subscriber clicks (maximum one per subscriber) per message sent, for all message types. Only messages containing links are included in the reported click-through rate statistics. The “Keyword-Opt-In Flow” message type refers to the opt-in confirmation and keyword reply sent to subscribers immediately after joining a store’s SMS list.

The performance data per message was first averaged for each individual store over messages sent by the store throughout the year. The store averages for each message type and performance statistic were then ordered from lowest to highest. The final ranges reported here span from the 25th percentile cutoff (the cutoff point for a given performance statistic where 25% of stores had a lower value and 75% were higher) through the 75th percentile cutoff (the cutoff point for a given statistic where 75% had a lower value and 25% were higher).

The ARMR/SLTV metrics were calculated by taking the daily snapshot metric and taking an average of that for 2022 for each shop. We then compared all the eligible shops together and found the values at the 25th, 50th, 60th, 75th, and 90th percentile.